Key Milestones

For the past 50 years, the Bank has made significant strides in fulfilling its mandate. Successive Boards have seen the Bank grow from a staff establishment of 60 in 1966 to over 1,300. In response to its expanding functions, the areas of operation have grown from its head office in Nairobi to three branches (Mombasa, Kisumu, Eldoret) and four centres (Nyeri, Nakuru, Meru, Kisii). With the enabling environment for effective growth, the Bank has witnessed a number of milestones in the country including the following:

Key Milestones

1905 Establishment of Mombasa Currency Board

1910 Standard Bank of South Africa established

1911 Standard Chartered Bank founded in Kenya

1916 Barclays Bank established in Kenya.

1919 Mombasa Currency Board replaced with a London based East African Currency Board

1921 Cessation of the Indian Rupee as a legal tender

1922 East African shilling replaces the Rupee exchanging at Sh2 a rupee

1951 General Bank of Netherlands, later known as ABN Amro, set up

1953 Bank of India and Bank of Baroda set up

1956 Habib Bank (overseas) Ltd set up

1957 Kisumu Currency Centre established under East African Currency Board (EACB)

1960 The headquarters of the EACB moved from London to Nairobi

1962 Commercial Bank of Africa, which was registered in Tanzania, opens a branch in Kenya.

1965 The first locally owned commercial bank, the Co-operative Bank of Kenya, registered under the Co-operative Societies Act

1966 March – enactment of Central Bank of Kenya Act. September – Official Opening of the Central Bank of Kenya at Herufi House. Kenya’s first currency banknotes issued to the public – denominations 5,10,20,50 & 100.

1967 Kenya’s first currency coins issued to the public – denominations 5ct, 10ct, 25ct, 50ct and KSh.1.

1968 The Cooperative Bank opens its doors for business. The National Bank of Kenya, the second locally owned bank, established

1971 Following agreement with the government, National and Grindlays banks’ commercial banking operations come under the control of the newly created Kenya Commercial Bank (KCB)

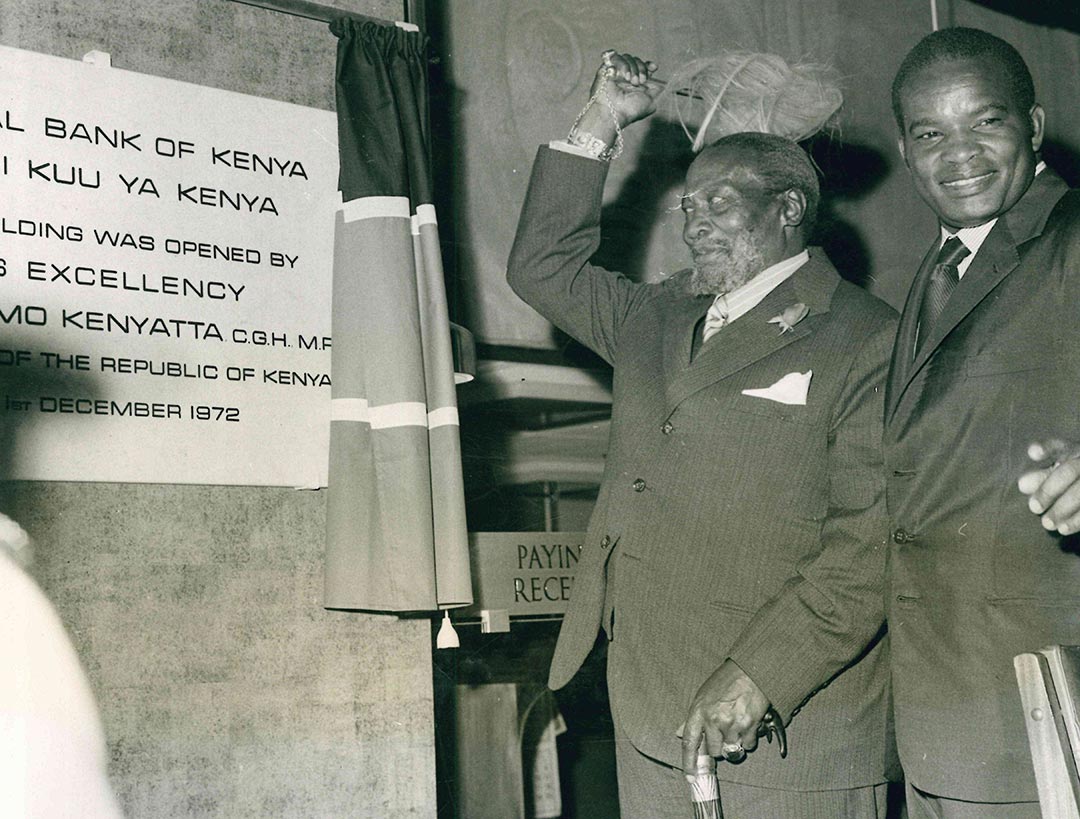

1972 CBK Head Office (current location) officially opened by Kenya’s first President Mzee Jomo Kenyatta

1973 The Industrial Development Bank (IDB) set up to provide long-term equity and capital to large-scale and medium industrial enterprises.

1977 Mombasa Currency Centre operations taken over by newly established CBK Mombasa Branch

1978 Official opening of CBK Mombasa Branch by Kenya’s first President the late Mzee Jomo Kenyatta

1981 CBK takes over operations of Kisumu Currency Centre from KCB

1983 Introduction of a crawling peg to replace the fixed exchange rate system of 1966 – 1982

1985 Banking Act (Chapter 488) amended to introduce an explicit deposit insurance scheme in Kenya – the Deposit Protection Fund Board (DPFB)

1986 New KSh.200 banknote introduced by CBK making it the highest denomination in circulation

1988 New KSh.500 banknote introduced by CBK making it the highest denomination in circulation

1989 Introduction of the first two automated teller machines (ATMs) by Standard Chartered Bank Kenya Ltd at its Moi Avenue branch

1991 Elimination of interest rates controls. CBK Eldoret Branch begins operations

1992 Kisumu Currency Centre upgraded to be CBK Kisumu Branch and starts operations in current building

1993 Introduction of a floating exchange rate regime

1995 Introduction of foreign exchange (forex) bureaus. New KSh.1,000 banknote introduced by CBK making it the highest denomination in circulation

1996 Non-bank financial institutions (NBFIs) required to convert to banks.

1997 CBK in partnership with Ministry of Finance establishes the Kenya School of Monetary Studies (KSMS)

1998 Full automation of the Nairobi Clearing House using the Magnetic Ink Character Recognition (MICR) technology to facilitate clearing of cheques

2002 Going live of Kenswitch – a shared financial switch consortium of more than 20 commercial banks in Kenya. Electronic Funds Transfer (EFT) payments introduced to the Automated Clearing House

2005 Risk Management Guidelines outlining the minimum coverage and elements of a comprehensive risk management programme issued. Introduction of the Kenya Electronic Payments and Settlements System (KEPSS) to help phase out the paper-based interbank settlement system

2006 Minister for Finance cedes operational supervisory powers of licensing, revocation of licenses, opening and closing of places of business and statutory management to the CBK. Enactment of the Microfinance Act, putting in place the necessary laws and regulatory framework for the establishment, licensing and supervision of microfinance banks

2007 Introduction of mobile money system in Kenya

2008 The Banking (Credit Reference Bureau) Regulations issued

2009 Enhancement of the minimum core capital requirements for commercial banks from Kshs 250 million in 2009 to Kshs 1 billion by end of 2012. Introduction of Agency banking through an amendment of the Banking Act. The Proceeds of Crime and Anti-Money Laundering Act was passed by Parliament. Introduction of cheque value capping to stop the processing of payments, cheques and Electronic Funds Transfers (EFTs), of Ksh.1 million and above through the Nairobi Automated Clearing House. Nyeri Currency Centre opened for operations

2010 Introduction of Credit Information Sharing mechanisms. Integration of mobile money with banks. Nakuru Currency Centre opened for operations

2011 Cheque truncation system is introduced to support the exchange of electronic cheque images without the conventional exchange of physical cheques. Meru Currency Centre opened for operations

2012 The Kenya Deposit Insurance (KDI) Act enacted in response to the need to expand the mandate of the Deposit Protection Fund Board (DPFB) as the banking sector’s resolution authority. Reduction of the cheque clearing period from T+3 to T+2 days

2013 CBK granted power to supervise institutions and their associates on a consolidated basis and in liaison with other competent authorities. Shortening of the cheque clearing period to T+1 days. Introduction of the East African Payments system (EAPS) to facilitate real-time settlement of financial transactions by the public through commercial banks in the region using the five East African currencies.

2014 Kenya joins the COMESA Regional Electronic Payment and Settlement System (REPSS). The REPSS eliminated the need for each commercial bank to use off-shore correspondent banks for inter-country settlements

2016 Legislation of the Banking (Amendment) Act that introduces a cap on lending rates of not more than four per cent above the Central Bank Rate and deposit rates at 70% of the CBR. CBK in collaboration with the National Museum of Kenya opens a Numismatic Gallery