Bank Supervision

Bank Supervision Overview

• Developing appropriate laws, regulations and guidelines that govern the players in the banking sector.

• Continuous review of the banking sector laws, regulations and guidelines to ensure that they remain relevant to the operating environment. These include the Banking Act (Cap 488), Microfinance Act (2006), Central Bank of Kenya Act (Cap 491) and Prudential Guidelines and Regulations issued thereunder.

• Licensing banks, non-bank financial institutions, mortgage finance companies, credit reference bureaus, foreign exchange bureaus, money remittance providers and microfinance banks.

• Inspection of commercial banks, microfinance banks, non-bank financial institutions, mortgage finance companies, building societies, credit reference bureaus, foreign exchange bureaus, money remittance providers and representative offices of foreign banks to ensure that they comply with all the relevant laws, regulations and guidelines and protect the interests of depositors and other users of the banking sector.

• Analysis of financial reports and other returns from banking sector players to ensure compliance with the relevant laws, regulations and guidelines.

• Contributing towards initiatives that promote financial inclusion.

Commercial banks and mortgage finance institutions are licensed and regulated in accordance with the provisions of the Banking Act and the Regulations and Prudential Guidelines issued thereunder. As key players in the banking sector, commercial banks and mortgage finance companies are subject to regulatory requirements governing their prudential position and market conduct in order to safeguard the overall soundness and stability of the financial system.

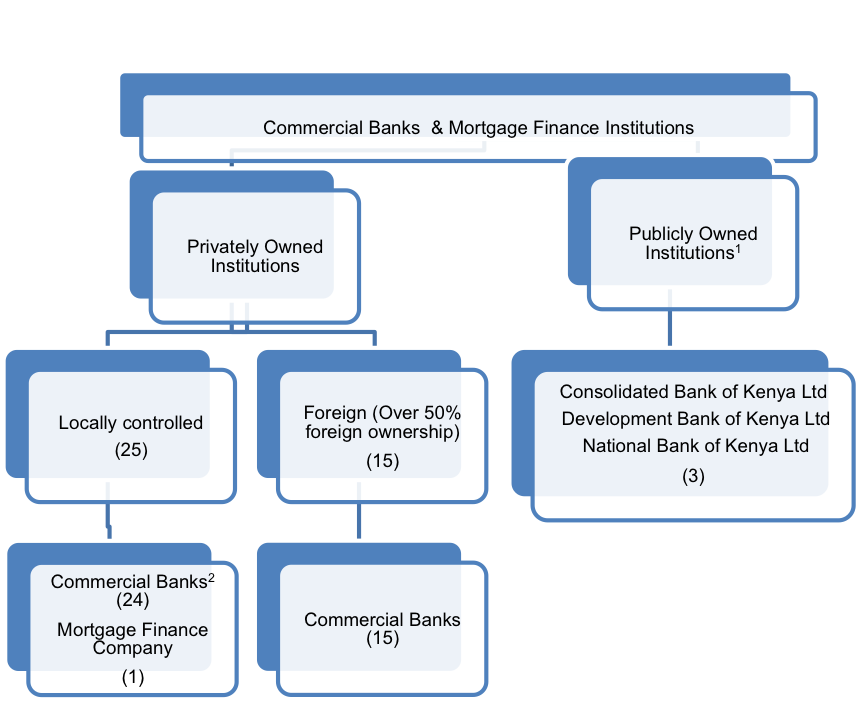

Commercial Banks and Mortgage Finance Companies

2 – As at the end of June 2016, of the 24 locally controlled institutions, 3 were not in operation – one was under statutory management and two were in receivership.

Microfinance banks are classified into two categories: community-based microfinance banks and nationwide microfinance banks. These institutions have proved instrumental in expanding financial inclusion or access to financial services, throughout Kenya.

Microfinance Institutions

The principal object of the Microfinance Act 2006 is to regulate the establishment, business and operations of deposit taking microfinance institutions in Kenya through licensing and supervision. The Act enables microfinance banks (MFBs) licensed by the Central Bank of Kenya to mobilise deposits from the general public, thus promoting savings, competition, efficiency and financial access.

As financial intermediaries, MFBs play a complimentary role to commercial banks, as opposed to being competitors, by offering a vital service channel to the significant proportion of the population in Kenya that lacks access to commercial banks. The microfinance industry therefore plays a pivotal role in deepening financial markets and enhancing access to financial services by a significant proportion of the population.

See our directory of licensed microfinance banks HERE.

Forex bureaus and money remittance providers play a pivotal role in ensuring fair foreign exchange rates, as more competition in the market reduces the spread of exchange rates. Forex bureaus deal purely with spot exchange of foreign currencies, while money remittance providers also enable customers to transfer money within or outside the country.

Forex Bureaus

As authorised dealers, forex bureaus conduct business and are regulated under the provisions of the sections 33A to 33(O) of the Central Bank of Kenya Act (Cap 491) and Forex Bureau Guidelines issued thereunder.

A Credit Reference Bureau (CRB) is an entity licensed to collect and collate credit information on individuals and businesses from different sources and provide that information upon request mainly by credit providers in the form of a credit report.

Credit Reference Bureaus

Background

The Kenyan banking sector was, particularly in the 1980s and 1990s, saddled with significant non-performing loans (NPLs), which led to the collapse of some financial institutions. One of the major contributors to this state of affairs were “serial defaulters,” who thrived in the “information asymmetry” environment that prevailed due to lack of a credit information sharing mechanism amongst financial institutions.

The development of a sustainable information sharing mechanism is recognised as a key component in improving the efficiency of financial intermediation. Towards this objective, banking sector stakeholders came together in 2008 and developed the Banking (Credit Reference Bureau) Regulations 2008, which governed the sharing of credit information on borrowers between providers of credit. Regulations initially provided for the sharing of only negative information. However, in 2013 revised CRB Regulations were issued that provided for the sharing of full file information (i.e. both positive and negative).

Benefits to the customer

• A credit report makes it easier for good customers to distinguish themselves from persistent defaulters, thereby attracting favourable loan terms.

• Financial institutions have online access to credit reports generated by the CRBs, resulting in reduced paperwork for the customer and faster processing of loans.

• By making credit histories more portable, customers are able to easily switch between financial institutions and thereby take advantage of competition to secure better credit terms.

Benefits to Credit Providers/Lenders

• CIS strengthens the credit risk management processes for financial institutions.

• It facilitates faster and more efficient reviews of customers’ credit or loan applications.

Benefits to the economy

• CIS creates an opportunity for a wider cross section of the population to access credit, particularly those with no access to tangible collateral.

• It is expected to reduce lending transaction costs while widely availing credit through reduced cost of credit and enhanced competition.

Key Highlights of the Credit Reference Bureau Regulations 2013

• A customer shall be entitled to a free copy of his credit report from a Bureau at least once per year.

• The consent of a customer is required for the submission or sharing of credit information, and such consent may be obtained by the customer signing any document giving express consent or authorisation for the sharing of credit information.

• A financial institution licensed under the Banking Act or Microfinance Act is required to submit both positive and negative credit information to CRBs on a monthly basis.

• A Bureau may, with the approval of the Central Bank, collect, receive, collate, compile and disseminate information relating to a customer of an institution that is obtained from a third party.

• Financial institutions have a duty to provide accurate credit information to CRBs.

• A customer has a right to dispute information contained in a credit report.

See our directory of licensed credit reference bureaus HERE.

Third-Party Credit Information Providers

The Credit Information Sharing mechanism is regulated in accordance with the Credit Reference Bureau Regulations (2020). The Regulations allow Credit Reference Bureaus (CRBs) to source for credit information from third parties in order to enhance their databases, to provide a complete and comprehensive credit history of the borrower. Through this arrangement, CRBs have been able to broaden their databases with data from third-party Credit Information providers (CIPs) after conducting due diligence on the sources and obtaining approval of CBK. Third-party CIPs are providers of credit information other than commercial banks, microfinance banks and deposit-taking savings and credit co-operative societies which are mandatory subscribers. The Regulations require that customers are protected and a mechanism for handling customer complaints be in place to ensure that customers’ complaints / disputes are handled expeditiously.

As at June 30, 2022, CBK had granted approval to CRBs to partner with the Third-Party Credit Information Providers listed in this Directory.

Representative Offices of Foreign Banks

Representative Offices in Kenya are established by foreign banks who wish to have a presence in the country without having to launch fully fledged banking operations. They are authorized and overseen by the Central Bank under the Banking Act and only permitted to undertake research, marketing and liaison roles on behalf of their parent and affiliated institutions. They are therefore not allowed to conduct banking business.

See our directory of foreign bank representative offices HERE.

Digital Credit Providers

The Central Bank of Kenya (Amendment) Act, 2021, which became effective on December 23, 2021, empowered CBK to license, regulate and supervise digital credit providers (DCPs) to ensure a fair and non-discriminatory marketplace for access to credit. Subsequently, the CBK Digital Credit Providers Regulations, 2022, were issued and operationalized on March 18, 2022.

See our directory of licensed digital credit providers Here

Other Financial Institutions

Non Bank Financial Institutions (NBFI) are licensed under the Banking Act and are obligated to comply with all requirements applying to banks subject to any stipulated conditions. Currently, there are no NBFIs licensed in Kenya.

Building Societies

Building Societies are licensed under the Building Societies Act by the Registrar of Building Societies. In their day to day operations, however, they are overseen by the Central Bank. Currently there are no licensed Building Societies in Kenya.

Risk Based Supervision (RBS) is a supervisory approach adopted by the CBK in supervision of licensed financial institutions in Kenya. Under this approach, the CBK assesses the risk profile of each institution and ascertains the effectiveness of the systems and procedures to identify, measure, monitor and control risks. A supervisory plan, detailing the supervisory resources needed for each institution (staff and time), is formulated having regard to the institution’s risk profile and risk management systems.

RBS Framework

The framework enables CBK to be more proactive and better positioned to pre-empt any serious threat to the stability of the financial system from current or emerging risks. The assessment of the effectiveness of risk management has become even more important as new technologies, product innovation, regional expansion, the size and speed of financial transactions have changed the nature of the banking sector. The principal benefits of the risk based supervisory approach are:

• Better evaluation of risks through separate assessment of inherent risks and risk management processes.

• Greater emphasis on early identification of emerging risks and system-wide issues.

• Cost effective use of resources through a sharper focus on risk.

• Reporting of risk focused assessments to institutions.

The Central Bank of Kenya’s RBS methodology is dynamic and will continue to be enhanced in line with international best practice and developments in the local, regional and international arena.