Read More

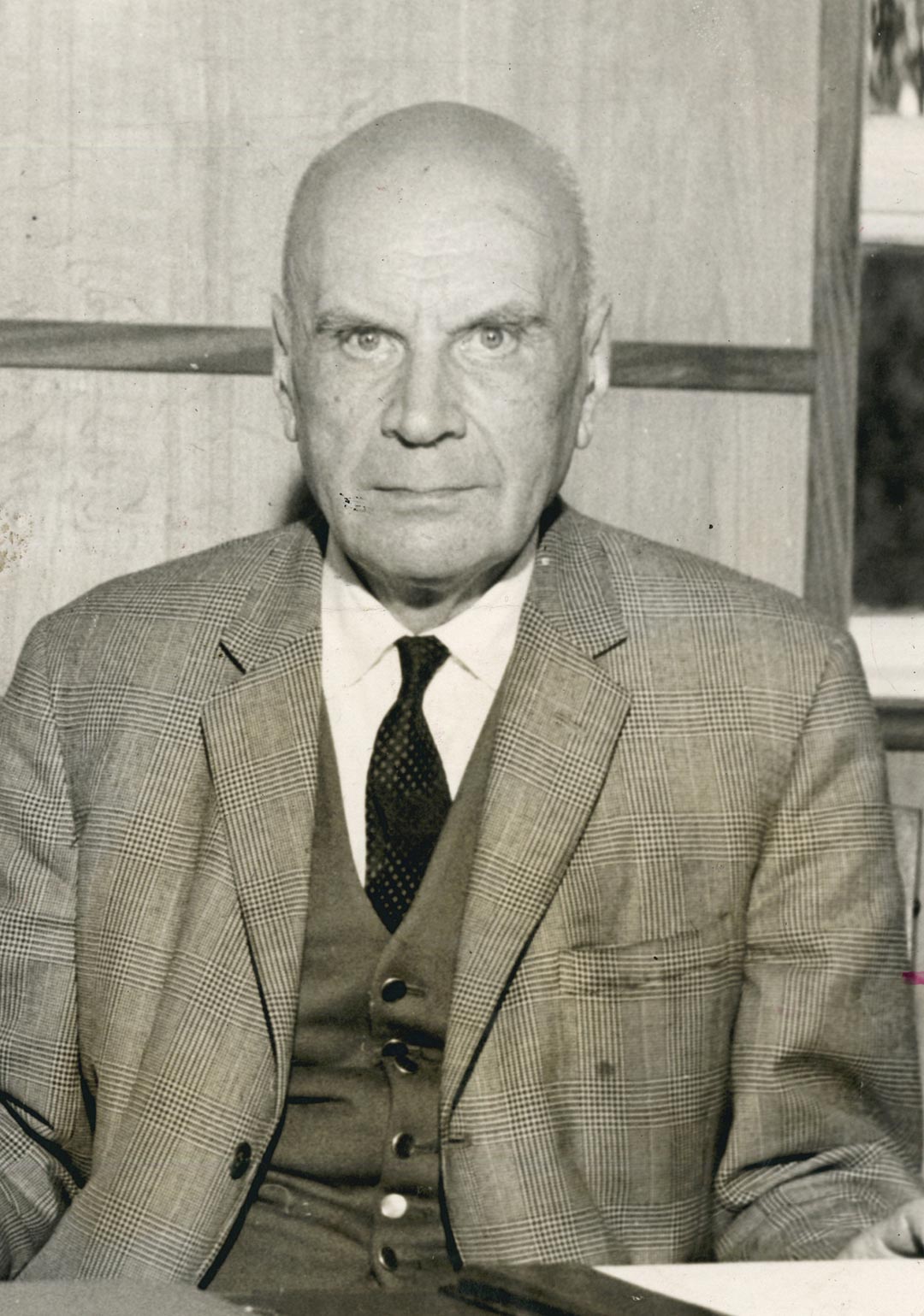

Dr. Baranski was appointed the first Governor in May 1966, on secondment from the International Monetary Fund (IMF). During his one year tenure, the CBK commenced operationalizing the CBK Act, assumed responsibility for monetary policy and management of the country’s external assets to nurture the emerging banking sector. The CBK also embarked on developing and issuing new currency notes and coins, providing banking services to the Government and commercial banks and overseeing the foreign exchange and exchange control operations.

Read More

Mr. Micah Cheserem was appointed Governor in July 1993, at a time when the economy was facing some serious challenges including high inflation and high interest rates, low reserves and a volatile exchange rate. The CBK took decisive steps to restore stability in the financial sector, which included amending the Central Bank of Kenya Act, 1996, granting the CBK operational autonomy in the conduct of monetary policy, and including price stability as one of CBK’s primary objectives. The CBK also began the first steps towards modernizing the National Payments Systems, with the automation of the Nairobi Clearing House in 1998.

Read More

Mr. Duncan Ndegwa was appointed Governor in May 1967. He led the Central Bank in receiving its first Special Drawing rights (SDRs) allocation based on Kenya’s quota in the IMF. During his tenor, Kenya enacted the Banking Act 1968, to enhance the functions of the CBK. He also oversaw the expansion, enhanced penetration and diversification of the banking and financial sector.

Read More

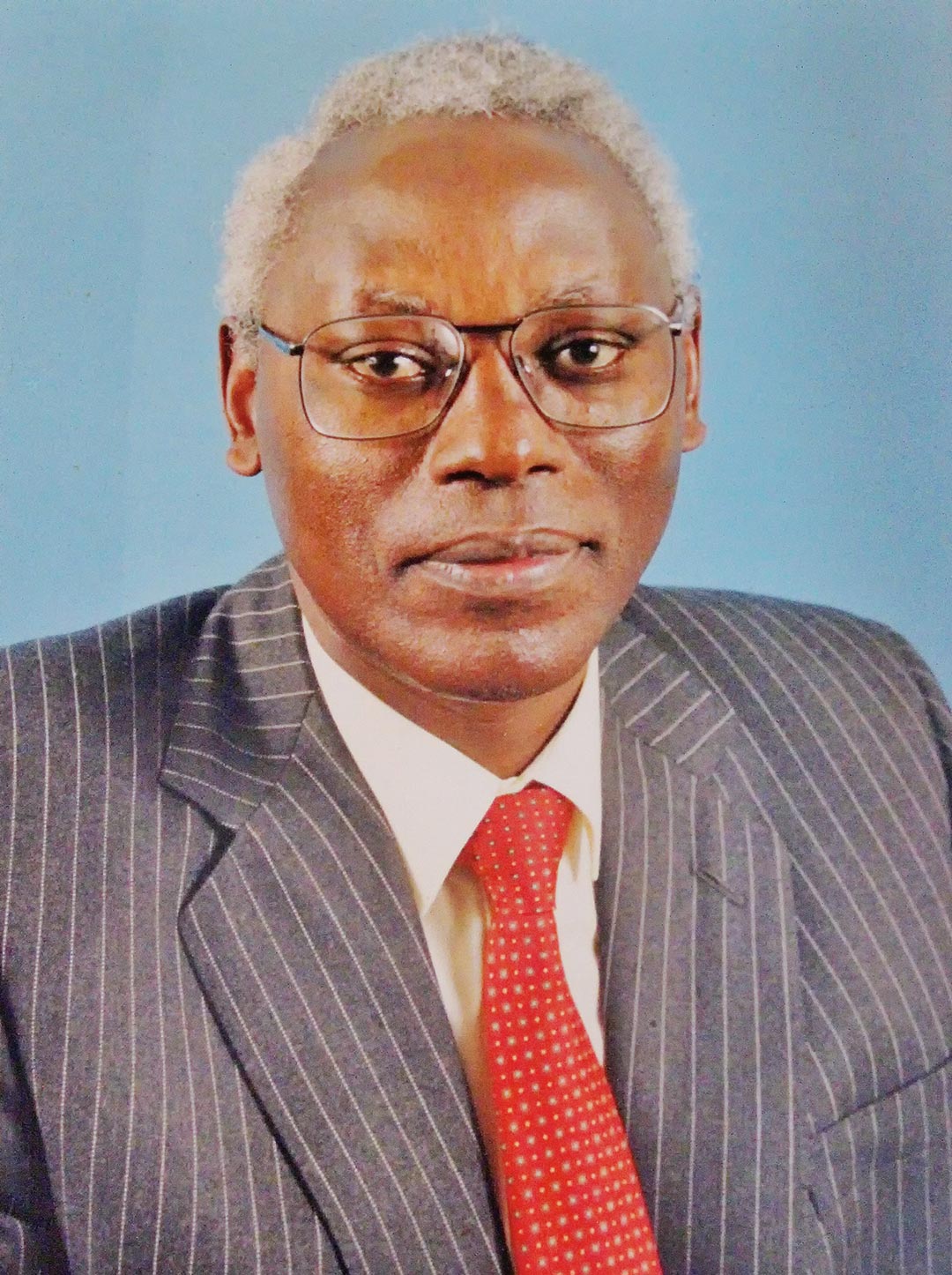

Mr. Nahashon Nyagah was appointed the sixth Governor in April 2001. He spearheaded the programme to promote and support development of government bonds market in Kenya. The initial objective was to lengthen the maturity profile of securities in the domestic debt portfolio in order to minimize refinancing risks associated with short-term debt and deepen financial markets. He established the Market Leaders Forum (MLF), a consultative forum that advised the CBK and the Treasury on bonds issuance, price and tenors and other matters relating to the government securities markets. This initiative revitalized the government bond programme and the debt portfolio skewed in favor of bonds over bills. The dominance of the longer dated government securities resulted in significant reduction in Treasury bill rates thus exerting downward pressure on market interest rates.

Read More

Mr. Philip Ndegwa was appointed Governor in December 1982. During his tenure, liberalization of the country’s economy was introduced. Owing to the Government Policy of transferring economic activity into the hands of indigenous Kenyans, the banking sector witnessed a large number of new entrants. Challenges within the banking sector led to the amendments to the Banking Act in 1985, primarily to protect small depositors. In addition, the Deposit Protection Fund Board (DPFB), a deposit insurance scheme to provide cover for depositors and act as liquidator of banks, was also introduced.

Read More

Dr. Andrew Mullei’s was appointed Governor in March 2003. His tenure was characterized by measures to promote greater efficiency and effectiveness of the payment, clearing and settlement system. The CBK implemented the Kenya Electronic Payments and Settlement System (KEPSS), the country’s Real Time Gross Settlement (RTGS) System in 2005. Implementation of KEPSS mitigated the risks associated with the previous paper-based inter-bank settlement system. He oversaw the operationalization of the Monetary Policy Advisory Committee (MPAC) in 2004 and the introduction of the Central Bank Rate (CBR) in 2006.

Read More

Mr. Eric Kotut was appointed Governor in January 1988. Under his leadership, the CBK took several steps towards liberalization of the financial sector, notably elimination of interest rate and foreign exchange controls. The Banking Act was further revised to increase CBK’s supervisory powers and broaden its responsibilities.

Read More

Prof. Njuguna Ndungu was appointed Governor in March 2007. He transformed the Monetary Policy Advisory Committee (MPAC) into the Monetary Policy Committee (MPC) in 2008 to give it executive powers to formulate monetary policy. He oversaw the rollout of mobile payment services that revolutionized access to financial services in Kenya thereby enhancing financial inclusion especially to the unbanked and under-banked population. He also oversaw the introduction of the agency banking, credit reference bureaus, and the development of the infrastructure bond programme in collaboration with the Treasury.